Introduction

Financial minimalism isn’t about restriction—it’s about freedom. If you’re overwhelmed by expenses, unclear goals, and a financial life that feels cluttered, this guide will show you how to cut the noise, simplify your money, and start building long-term value with confidence.

The Core Principles of Financial Minimalism

At its heart, financial minimalism is a lifestyle that prioritizes intention over impulse. It helps you focus on what truly adds value while eliminating the costs—financial, mental, and emotional—that weigh you down.

Here are the core ideas:

Spend with purpose.

Eliminate unnecessary financial clutter.

Channel resources toward long-term value, not short-term comfort.

Build habits that create sustainability, not stress.

People often pursue minimalism for its financial benefits, but the real win comes from clarity and control. You stop reacting to money—and start directing it.

Step 1: How to Simplify Your Financial Life

Before you can invest or make long-term plans, you need a clean foundation. Here’s a practical, step-by-step process to declutter your financial world.

1. List all your expenses

Every recurring bill, subscription, and loan payment should be visible. Hidden expenses create hidden stress.

2. Group them into three categories

• Essentials (housing, food, utilities)

• Personal priorities (fitness, education, hobbies)

• Non-essentials (unused subscriptions, impulse purchases)

3. Eliminate unnecessary recurring costs

Ask yourself: Does this expense bring long-term value? If not, cut it. This single step can free up thousands per year.

4. Automate what matters

Set up automation for:

• Savings

• Investments

• Debt payments

Automation removes decision fatigue and keeps your system simple.

5. Track progress monthly

Financial minimalism is a lifestyle—not a one-time fix. A monthly review keeps you aligned with your goals and helps prevent old habits from creeping back.

Step 2: Choosing Long-Term Value

Minimalist finances revolve around the idea of value over volume. Instead of buying more, you choose better.

Here’s how to identify long-term value:

1. Look for investments that grow

Items or decisions that appreciate or enhance future opportunities—like education, skills, and long-term savings—offer compounding benefits.

2. Prioritize quality over quantity

One durable, well-chosen purchase prevents multiple cheap replacements. This applies to everything—from kitchen items to technology.

3. Align spending with your purpose

Does this align with your long-term goals? If the answer is no, it doesn’t belong in your financial life.

4. Evaluate the “lifetime cost” of decisions

A cheaper price tag today doesn’t mean a lower cost tomorrow. Long-term value usually wins.

Step 3: Smart Investment Choices for Small Resources

You don’t need a fortune to start investing. In fact, many people practicing financial minimalism begin with modest amounts and build consistency before volume.

Here are smart investment options even if you’re starting small:

• Low-cost index funds

• Government bonds

• High-yield savings accounts

• Micro-investing apps

• Retirement accounts with employer matching

• Fractional shares

• Skill-building courses that improve earning potential

Remember: Small, steady investments matter more than occasional large ones. The secret of financial minimalism is long-term discipline—not speed.

Step 4: Practicing Minimal Spending Without Feeling Restricted

Minimal spending isn’t the same as being cheap. It’s about making your money work harder for your life—not shrinking your life to fit your income.

Here’s how to spend less while enjoying more:

1. Adopt the “24-hour rule”

Pause before non-essential purchases. This simple delay cuts impulsive spending dramatically.

2. Use a values-based budget

Instead of tracking every penny, create spending categories tied to your values. For example:

• Health

• Learning

• Family

• Experiences

If something doesn’t fit a category, it doesn’t get funded.

3. Embrace “less but better”

Upgrade slowly to quality items that last longer, rather than buying low-cost replacements repeatedly.

4. Reframe entertainment

Free or low-cost experiences—nature walks, home cooking, library visits, DIY wellness—can enrich your life without draining your wallet.

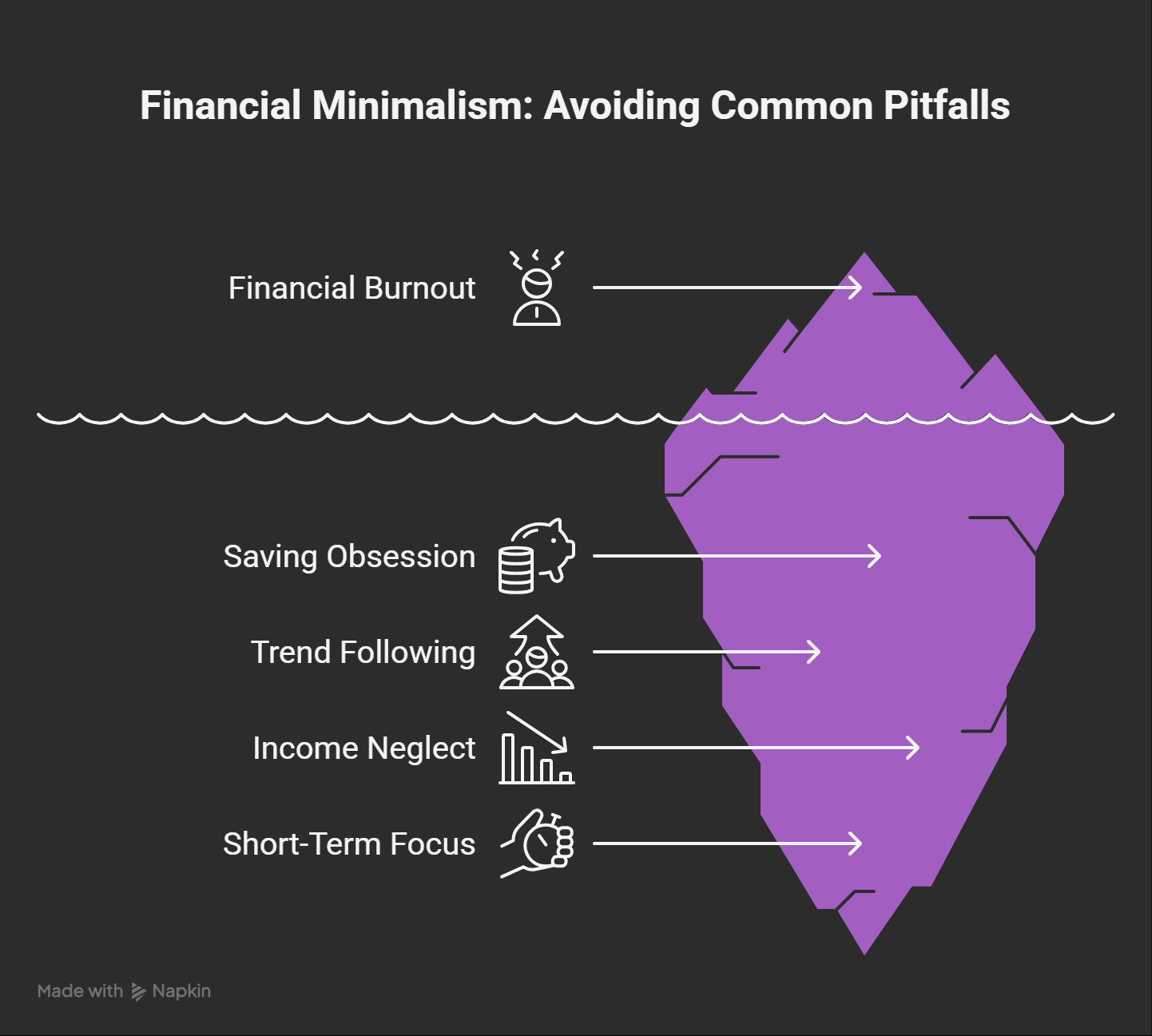

Common Mistakes to Avoid

Even with the best intentions, many people fall into these traps when trying to practice financial minimalism:

1. Cutting too much too quickly

Financial burnout is real. Gradual changes stick better.

2. Fixating only on saving

Minimalism is about balance—not deprivation. Saving without investing limits your long-term growth.

3. Following trends instead of values

Minimalism isn’t aesthetic—it’s personal. Your financial priorities won’t look like someone else’s.

4. Ignoring income growth

You can only cut so much. Skill development and strategic earning matter just as much as reducing expenses.

5. Treating minimalism as a short-term fix

Consistency is where the transformation happens. Long-term commitment builds real wealth.

Conclusion

Financial minimalism gives you the freedom to focus on what truly matters—your goals, your growth, and your future. You don’t need to overhaul your entire life today. Start with one simple change: cancel an unused subscription, track your expenses for the week, or automate a small savings deposit.

Small steps create big impact.

Start today, simplify your financial life, and watch clarity—and wealth—begin to grow.